Changes to TRIS

The good old days of a Transition to Retirement Income Stream (TRIS) receiving tax free earnings is now a distant memory for most SMSFs.

Effective 1 July 2017, the Australian Government have removed the tax exemption on earnings received from assets supporting a TRIS that is not in ‘retirement phase’. The intention of this change is to ensure that a TRIS is used to support an individual transitioning from the workforce to retirement, not as a tool to reduce income tax. Whether a TRIS is entitled to receive tax exempt earnings will now depend on whether the TRIS is considered to be a ‘retirement phase’ or ‘non-retirement phase’ income stream. To truly understand what this means and what has changed, we have broken it down for you.

For members who are paying themselves a TRIS, it is important that they are aware of when their TRIS is eligible to become a retirement phase income stream and notify the fund’s Trustees immediately. Such delays could have a substantial impact on the fund’s ECPI.

Prior to 1 July 2017

Previous to 1 July 2017, earnings received on assets supporting a TRIS were tax exempt. SMSFs with assets supporting a TRIS as well as accumulation interests throughout the financial year (i.e. unsegregated assets) would need to obtain an actuarial certificate to claim Exempt Current Pension Income (ECPI). Furthermore, for members who had reached preservation age but were under the age of 60, they could elect to treat their super income stream benefits as lump sums and receive them tax free up to the low rate cap amount. For the 2017/18 financial year and onwards, these two tax breaks have now significantly changed.

1 July 2017 and onwards

Effective 1 July 2017, the election to treat super income stream benefits as lump sums for tax purposes has been removed. Furthermore, the tax exemption on earnings received from assets supporting a TRIS in ‘non-retirement phase’ has also been removed. A TRIS will now be categorised as either a TRIS in ‘non-retirement phase’ (i.e. earnings are 100% taxable) or a TRIS in ‘retirement phase’ (i.e. earnings are 100% tax exempt). Let’s dig a little deeper into what this terminology means and its implications.

TRIS in Non-Retirement Phase

When a member reaches preservation age and commences a TRIS without satisfying a nil cashing restriction, the TRIS will be classified as a ‘non-retirement phase’ income stream. Under this definition, all the earnings received from the assets supporting the TRIS will be 100% taxable and taxed at 15% regardless of the date the TRIS originally commenced. A TRIS in non-retirement phase will not be shown as a credit against the member’s Transfer Balance Account.

TRIS in Retirement Phase

For a TRIS to be classified as a ‘retirement phase’ income stream, one of the following criteria needs to be satisfied:

• The member is at least 65 years of age, or

• The member has met a condition of release with a nil cashing restriction (e.g. retirement, terminal medical condition or permanent incapacity) and the Trustees have been notified.

Once the member has satisfied one of the above criteria, the TRIS’ earnings will be tax exempt from then onwards. For a fund that has a mix of accumulation and TRIS in retirement phase during the financial year, the SMSF will need to obtain an actuarial certificate if they wish to claim ECPI under the unsegregated method.

It is also important to note that at the date the TRIS becomes a retirement phase income stream the value of the superannuation interest supporting the TRIS will be reflected as a credit against the member’s Transfer Balance Account. For a member who was receiving a TRIS in retirement phase at 1 July 2017, a credit will arise on the member’s Transfer Balance Account equal to the value of the superannuation interest supporting the TRIS at 1 July 2017

Example: A TRIS converting from ‘non-retirement phase’ to ‘retirement phase’

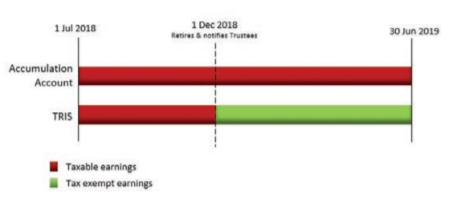

Samuel is the sole member of the Smooth Sailing Super Fund. At 1 July 2017, Samuel is 58 years old and holds an accumulation account as well as a TRIS. Samuel has not satisfied a nil cashing restriction and therefore his TRIS is a non-retirement phase income stream and all the earnings are entirely taxable. For the 2017/18 financial year, Samuel continues to hold his accumulation account as well as his TRIS. As all the interests held by the member are entirely taxable, the fund would not be eligible to claim ECPI in the 2017/18 financial year and an actuarial certificate would not be required.

In the 2018/19 financial year, Samuel fully retires on his 60th birthday being 1 December 2018. As Samuel has met a nil cashing restriction, he notifies the Trustees of the Smooth Sailing Super Fund that his TRIS can now be classified as a retirement phase income stream. From 1 December 2018, the earnings received on the assets supporting the TRIS are entitled to a tax exemption. As there is a mix of superannuation interests supporting both accumulation and retirement phase throughout the 2018/19 financial year, the SMSF will need to obtain an actuarial certificate to determine the proportion of tax exempt income if they choose to claim ECPI under the unsegregated method. Furthermore, a credit will arise on Samuel’s Transfer Balance Account equal to the value of the superannuation interest supporting the TRIS on 1 December 2018.

Note: If Samuel did not notify the Trustees that he had met a nil cashing restriction and his TRIS could now be classified as a retirement phase income stream then his TRIS would have continued as a non-retirement income stream until otherwise notified.

Conclusion

For members who are paying themselves a TRIS, it is important that they are aware of when their TRIS is eligible to become a retirement phase income stream and notify the fund’s Trustees immediately. Such delays could have a substantial impact on the fund’s ECPI.

References

Section 307.80 of the Income Tax Assessment Act 1997. http://www5.austlii.edu.au/au/legis/cth/consol_act/ itaa1997240/s307.80.html

Australian Taxation Office, Changes to transition-to-retirement income streams, last updated 23 October 2017, viewed 21 May 2018. https://www.ato.gov.au/individuals/super/super-changes/change-to-transition-to-retirement-income-streams/

Australian Taxation Office, Removal of election to treat super income streams as lump sums, last updated 28 November 2017, viewed 21 May 2018. https://www.ato.gov.au/Individuals/Super/Super-changes/ Removal-of-election-to-treat-super-income-streams-aslump-sums/

Rebecca Oakes B.Bus, Adv Dip FP, SSA

Head of Technical Services

1800 230 737 | rebecca@act2.com.au