Everything you need to know on Deemed Segregation

The Australian Taxation Office (ATO) have provided further guidance on when it is compulsory to use the segregated method for the purposes of claiming Exempt Current Pension Income (ECPI). This guidance was not consistent with previous industry practice and as a result, calculating ECPI will be a whole different ballgame.

What was industry practice?

Prior to the 2017/18 financial year, it was the industry’s understanding that if an SMSF had not clearly set aside assets to be segregated current pension assets or the fund’s assets were not solely supporting pension phase for the entire year of income, the fund would need to use the unsegregated method to claim ECPI. In these circumstances, the tax exempt percentage obtained via an actuarial certificate would apply to earnings received throughout the entire income year, regardless of whether there were periods of full pension phase. This is no longer the case.

What has changed?

For an SMSF that is eligible to use the segregated method in a given financial year, if at any stage during that year there are periods where the assets are solely supporting retirement income streams then those periods are ‘deemed’ to be segregated (these periods may be as short as just one day). Earnings received during the deemed segregated periods can only be exempt from income tax using the segregated method.

For income received outside of the deemed segregated periods, the unsegregated method will be used to calculate ECPI (assuming the fund hasn’t specifically segregated any current pension assets). The actuary’s tax exempt percentage is calculated over the periods that are not deemed segregated periods (i.e. the unsegregated periods) and the tax exempt percentage will apply only to income received during the unsegregated periods.

This means that administrators of SMSFs will need to value the fund’s assets every time the fund goes into full pension phase (i.e. moves from unsegregated to segregated) and every time the fund goes out of full pension phase (i.e. segregated to unsegregated) in order to identify the income received in each of those periods.

The ATO have confirmed that they will not be reviewing ECPI calculations in the 2016/17 financial year and prior for SMSFs that have used the unsegregated method for the entire financial year despite there being periods of 100% pension phase.

Note: The concept of ‘deemed’ segregation only applies if an SMSF is eligible to use the segregated method within a given financial year. Is your SMSF eligible to use the segregated method?

Examples

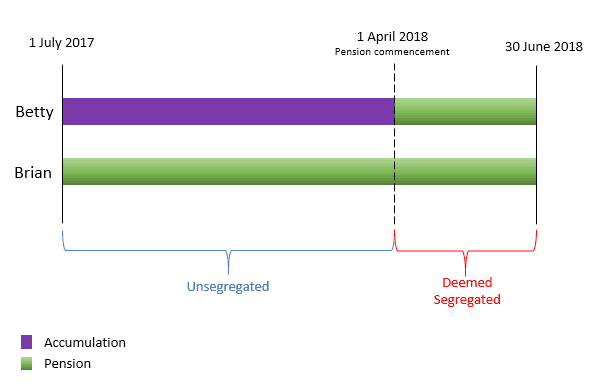

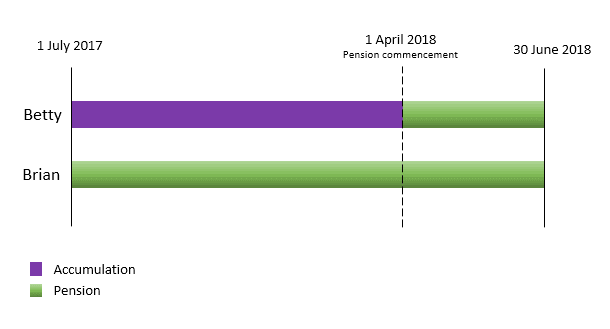

Example 1: Pension and Accumulation to full Pension

Brian and Betty are members of the Better Days Super Fund. At 1 July 2017, Brian’s entire superannuation interest is paying an Account Based Pension (ABP) and Betty is solely in accumulation phase. On 1st April 2018, Betty turns 65 and commences an ABP with her entire accumulation balance. From 1st April 2018, all of the fund’s assets are solely supporting retirement income streams.

Just prior to the beginning of financial year, neither member had a Total Superannuation Balance that exceeded $1.6 million and therefore the SMSF is eligible to use the segregated method in the 2017/18 financial year.

Under the ATO’s guidelines, as all of the SMSF assets are used to support pension liabilities for the period 1 April 2018 - 30 June 2018, all of the fund’s assets are deemed to be segregated current pension assets for that period. The Trustees will need to ensure that they know the market value of the fund’s assets (and hence current member balances) on 1 April 2018 in order to determine the income received during this deemed segregated period. As there is a mix of accumulation and pension interests for the period 1 July 2017 – 31 March 2018, the fund will use the unsegregated method to calculate ECPI for that period.

Note: When the actuary prepares the actuarial certificate, they will only be taking into consideration the assets for the unsegregated period (e.g. 1 July 2017 – 31 March 2018).

The ECPI for the Better Days Superannuation Fund for the 2018 financial year will be calculated as follows:

| Unsegregated ECPI |

$7,700

(70% x $11,000) |

|

PLUS

Segregated ECPI

|

$4,000 (All income earned from segregated current pension assets are 100% tax exempt) |

|

EQUALS

Total ECPI

|

$11,700 |

The Trustees would show $11,700 against ‘Exempt Current Pension Income’ in their SMSF annual return.

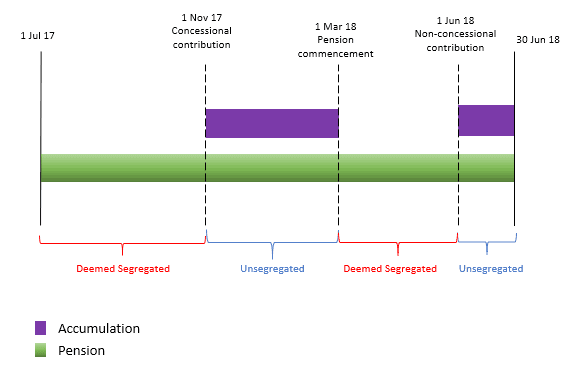

Example 2: Multiple periods of unsegregated and segregated assets

Example 2: Multiple periods of unsegregated and segregated assets

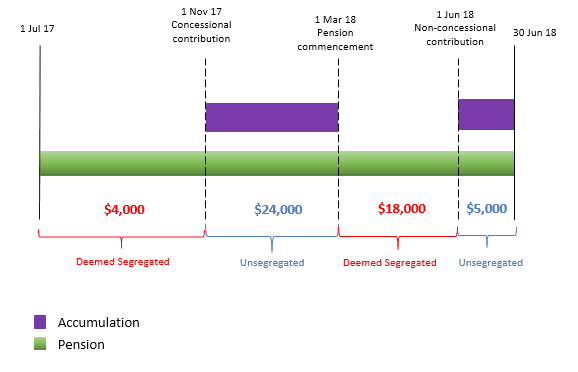

Peter is the sole member of the Time to Relax Super Fund. At 1 July 2017, Peter is receiving an ABP and his assets are solely supporting pension phase. On 1 November 2017, Peter receives a concessional contribution from his employer but doesn’t commence a pension with this amount until 1 March 2018. On 1 June 2018, Peter makes a non-concessional contribution into his fund and leaves this in accumulation phase for the remainder of the financial year. Just prior to the beginning of the 2017/18 financial year, Peter’s Total Superannuation Balance did not exceed $1.6 million and therefore the SMSF is eligible to use the segregated method in the 2017/18 financial year.

In this example there are two periods where all the fund’s assets are solely supporting pension liabilities and will be deemed segregated: 1 July 2017 – 31 October 2017 and 1 March 2018 – 31 May 2018. The Trustees will need to ensure that the assets are valued at the start and end of each of those periods in order to be able to identify the income received during the segregated periods.

Let’s assume the following ordinary and statutory income is received in the following periods:

The Trustees for the Time to Relax Super Fund apply for an actuarial certificate for the unsegregated periods. The actuary’s tax exempt percentage is calculated at 80%. The ECPI for the 2018 financial year would be calculated as follows:

| Unsegregated ECPI |

$23,200

($24,000 + 5,000) x 80% |

|

PLUS

Segregated ECPI

|

$22,000 ($4,000 + $18,000) (All income earned from segregated current pension assets are 100% tax exempt) |

|

EQUALS

Total ECPI

|

$45,200 |

The Trustee would show $45,200 against ‘Exempt Current Pension Income’ in their SMSF annual return.

Note: Despite there being multiple unsegregated periods, an SMSF only requires one actuarial certificate per year to claim ECPI under the unsegregated method. There will be only one actuary’s tax exempt percentage issued that will cover the income received over the multiple unsegregated periods.

Can ‘deemed’ segregation be avoided?

Can ‘deemed’ segregation be avoided?

For some SMSFs, the costs and time taken associated with additional interim reporting may outweigh the benefit of having ‘deemed’ segregated current pension assets. For SMSFs that are eligible to use the segregated method and do not want to be caught out by the additional interim reporting associated with ‘deemed’ segregation could consider leaving $10 in accumulation for the entire financial year. By leaving an amount in accumulation, at no stage during the financial year will the fund’s assets be entirely supporting pension phase and be deemed segregated. As a result, the fund would use the unsegregated method for the given financial year and an actuarial certificate would apply to the full year of income.

Conclusion

From 2017/18 and onwards, SMSFs that are in a position of having to use both the unsegregated method and the segregated method in a given financial year will need to ensure that they can clearly identify the income received in both the segregated and unsegregated periods in order to be able to calculate the fund’s ECPI correctly.

Reference

Australian Taxation Office, Requirements for claiming the tax exemption, last updated 5 September 2017, viewed 9 April 2018.

Example 2: Multiple periods of unsegregated and segregated assets

Example 2: Multiple periods of unsegregated and segregated assets

Can ‘deemed’ segregation be avoided?

Can ‘deemed’ segregation be avoided?