Two sections added to Act2 actuarial certificates

Act2 Solutions have recently updated their actuarial certificate to reflect the Exempt Current Pension Income (ECPI) changes that came into effect for the 2017/18 financial year. There are two new and important sections added to the actuarial certificate that you need to be aware of.

Eligibility to use the segregated method

The first new section added to the actuarial certificate that you need to be aware of is section 1.4 ‘Other Information’. The first dot point under this section will highlight whether the fund has Disregarded Small Fund Assets (i.e. ineligible to use the segregated method) or there are no Disregarded Small Fund Assets (i.e. eligible to use the segregated method). It is important to make sure this statement is correct as for some funds it will determine whether they have deemed segregated assets or not. An example screenshot of the new section 1.4 ‘Other Information’ follows below.

1.4 Other Information

Based on the information provided to us, we understand that: · there were no Disregarded Small Fund Assets as defined in section 295-387 of the Act applicable to the Fund at any time during the year of income;

Whether a fund has Disregarded Small Fund Assets or not is based on what you declare when completing the actuarial certificate application. We recommend getting in the habit of double checking that this statement is correct every time you receive an actuarial certificate as a simple error could potentially have a material impact on the actuary’s tax exempt percentage.

One mistake we are beginning to see from clients is in relation to the question ‘Is the SMSF eligible to use the segregated method for claiming ECPI in the given income year?’. On the application form, some clients are automatically assuming that the question being asked is whether the fund has elected to set aside assets during the year to be segregated. This is incorrect. The question being asked is whether the fund has Disregarded Small Fund Assets or not. In other words, if there is a member just prior to the beginning of the financial year that has a Total Super Balance of more than $1.6 million and is receiving a retirement income stream (whether it is inside or outside the SMSF) then the fund will have Disregarded Small Fund Assets (i.e. ineligible to use the segregated method). To learn more about Disregarded Small Fund Assets you can read more about it here.

ECPI Method

The second new section added to the actuarial certificate that you need to be aware of is section 1.2 ‘Relevant Periods of the Income Year’. This section identifies if the fund has deemed segregated periods, and if so, when those periods occurred. It will also confirm the tax treatment on the relevant earnings throughout the financial year. This section is reliant on whether the fund can use the segregated method or not, so once again make sure you are satisfied with the statement that is provided under section 1.4 ‘Other Information’. One of the biggest misconceptions we have seen lately relating to actuarial certificates is that if there are two or more unsegregated periods during a given financial year then an actuarial certificate is required for each period. This is incorrect. Regardless of how many unsegregated periods there are in a given year, an SMSF will only require one actuarial certificate per financial year in order to claim ECPI under the unsegregated method. To clear things up, let’s run through an example of how to calculate ECPI when there are multiple unsegregated and deemed segregated periods.

Example 1

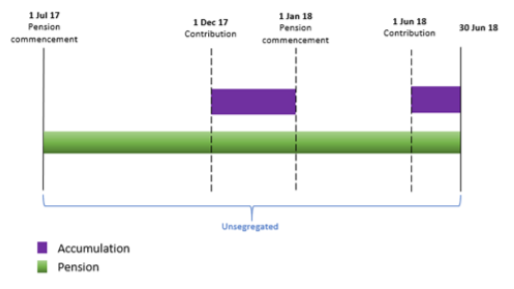

William is the sole member of the Wild & Free Super Fund. Just prior to the beginning of the 2017/18 financial year, William’s Total Superannuation Balance

is less than $1.6 million. This means that the Wild & Free Super Fund is eligible to use the segregated method for the 2017/18 financial year. At 1 July 2017, William commences an Account Based Pension with his entire accumulation balance. On 1 December 2017, William receives a contribution and doesn’t commence pension with that amount until 1 January 2018. William remains entirely in pension phase until 1 June 2018 when he receives another contribution.

When William receives the actuarial certificate from Act2 Solutions he notes the actuary’s tax exempt percentage on the opening page of the actuarial certificate. However, it is important that William also reviews section 1.2 to ensure that he applies the actuary’s percentage only to the income received during the unsegregated periods of the given financial year

From the actuarial certificate, William can see that he will need to use the segregated method for the periods 1 July 2017 – 30 November 2017 as well as 1 January 2018 – 31 May 2018 and all the ordinary and statutory income received during these periods will be tax exempt. Furthermore, William can also see that for the unsegregated periods of 1 December 2018 – 31 December 2018 and 1 June 2018 – 30 June 2018, the actuary’s tax exempt percentage of 90.100% will be applied to the total ordinary and statutory income received during those periods.

William also double checks section 1.4 ‘Other Information’ to ensure that it states there were no Disregarded Small Fund Assets (i.e. the SMSF is eligible to use the segregated method for the 2017/18 financial year).

1.4 Other Information

Based on the information provided to us, we understand that:

· there were no Disregarded Small Fund Assets as defined in section 295-387 of the Act applicable to the Fund at any time during the year of income;

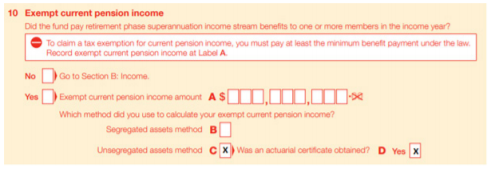

When completing section 10 of the 2018 SMSF annual return, William will mark an X in both box B and C to indicate that both the segregated assets method and unsegregated assets method were used to calculate ECPI.

Example 2

Referring back to example 1, let’s say that this time William had a Total Superannuation Balance of more than $1.6 million just prior to the beginning of the 2017/18 financial year. As William Total Superannuation Balance exceeds $1.6 million and he is also a recipient of a retirement phase income stream, the Wild & Free Super Fund is ineligible to use the segregated method for the 2017/18 financial year. As a result, despite there being periods of full pension phase during the given financial year, the fund is ineligible to have deemed segregated assets. When claiming ECPI, the fund will need to use the unsegregated method for the entire financial year and the actuary’s tax exempt percentage will apply to the ordinary and statutory income earned over the entire financial year.

When William applies for an actuarial certificate, he will state ‘No’ to the question ‘Is the SMSF eligible to use the segregated method for claiming ECPI for the 2017/18 income year?’. Below is an example of how e in this scenario.

When completing section 10 of the 2018 SMSF annual return, William will mark an X in only box C to indicate that the unsegregated assets method was used to calculate ECPI.

Conclusion

It is important for Trustees and SMSF administrators to understand whether their fund is eligible to use the segregated method or not in a given financial year as answer to this question could have a bearing on whether the fund has deemed segregated assets or not. Providing an incorrect answer to this question may potentially have a material impact on the actuary’s tax exempt percentage as well as the amount of ECPI claimed.

Reference

Disregarded Small Fund Assets – Section 295.387 of the Income Tax Assessment Act 1997 http://www5.austlii.edu.au/au/legis/cth/consol_act/ itaa1997240/s295.387.html

Rebecca Oakes B.Bus, Adv Dip FP, SSA

Head of Technical Services

1800 230 737 | rebecca@act2.com.au