Let us break down the five most common mistakes we see when it comes to failing to meet the minimum pension standards.

Account Based Pensions (ABP) are required to pay a minimum amount each financial year in order to satisfy the minimum pension standards and be eligible to claim Exempt Current Pension Income (ECPI). It is important that recipients of retirement income streams ensure that they satisfy the minimum pension standards each financial year as failing to do so could result in a loss of tax-exempt earnings.

Calculating the minimum pension amount

To truly understand how a simple oversight can result in a member failing to meet the minimum pension standards, it is firstly important to understand how a minimum pension payment is calculated. As specified under Schedule 7 of the Superannuation Industry (Supervision) Regulations 1994, the minimum pension amount for ABP that commenced on or after 20 September 2007 is calculated as follows:

Minimum payment amount* =

Account Balance x Percentage Factor

*rounded to the nearest 10 whole dollars

Where:

Account Balance is the value at 1 July of the given financial year or if the pension commenced during the financial year then the purchase price of that new pension.

Percentage Factor is the percentage specified in the table below based on the recipient’s age on 1 July of the given financial year or if they commenced a pension during the year, then their age at the commencement date.

| Age | Percentage Factor* | |

|---|---|---|

| Under 65 | 4.0% | |

| 65-74 | 5.0% | |

| 75-79 | 6.0% | |

| 80-84 | 7.0% | |

| 85-89 | 9.0% | |

| 90-94 | 11.0% | |

| 95 or more | 14.0% | |

For pensions that commenced or ceased during a given financial year, the minimum pension payment amount is pro-rated. For example formulas of how the minimum payment amount would be calculated if there was a pension commencement or rollback during the year see Appendix 1. Remember, the answer is always rounded to the nearest 10 whole dollars and an ABP that commenced on or after 1 June is not required to make a minimum pension payment for that financial year. Now that we have covered the basics, lets break down the five most common mistakes we see when it comes to failing to meet the minimum pension standards.

Mistake #1: Not making pension payments in form and effect

One of the most common mistakes we have seen among Administrators/Trustees is recording a journal entry at year end for the insufficient amount of pension payments that were not taken during the financial year. It is important to understand that this does not satisfy the minimum pension standards. In order to meet the minimum pension standards, the Trustee must make the pension payment in form and effect. This means the payment must be cashed (i.e. paid) prior to the end of the given financial year. The ATO clarify that a benefit is ‘cashed’ when the member receives an amount and the member’s benefits in the SMSF have been reduced.

Mistake #2: Not making a pro-rata pension payment before a pension stops and restarts

We often see members ceasing their pension during the financial year, receiving a contribution and recommencing pension with the full amount including the contribution. Some Trustees mistakenly believe that if they meet the annual minimum pension payment after they recommence the pension then this will satisfy the minimum pension standards. This is incorrect. A pro rata minimum pension payment needs be paid prior to initial pension ceasing in order for the pension standards to be met on the first pension. Then, a pro rata minimum pension payment needs to be paid after the second pension commences in order for the pension standards to be satisfied on the second pension.

Mistake #3: Rollovers satisfying minimum pension standards in another fund

There is a misconception among some that if a pension interest has satisfied the minimum pension standards in an external super fund and then is rolled over into pension phase in an SMSF, the minimum pension standards do not have to be met again for that financial year. This is incorrect. When pension monies are moved from an external super fund into an SMSF, the pension ceases and the rollover received by the SMSF forms part of the member’s accumulation interest. A new pension needs to be commenced within the SMSF for the monies to move back into pension phase. Therefore, as the member is starting a new pension in the SMSF the minimum pension standards need to be satisfied on that new pension.

Mistake #4: Not understanding the minimum pension payment requirements when a member passes away

When a member passes away during the financial year, there is some confusion surrounding what is required when it comes to satisfying the minimum pension standards. The answer to this question depends on whether the pension was set up as reversionary or non-reversionary. If the member’s pension was reversionary then the minimum pension standards will still need to be satisfied. The beneficiary of the reversionary pension will need to ensure that the pension payments the deceased member made prior to passing away plus the pension payments the beneficiary withdrew from the reversionary pension satisfies the minimum pension standards for that year.

If the pension was originally established as a non-reversionary pension then there is no requirement for the minimum pension standards to be satisfied in the year that the member passed away. The retirement phase income stream will continue to receive tax exempt earnings as long as the interest is paid out as soon as practicable1 and in no more than two instalments2. It is also important to note that if the deceased member’s benefits are later used by a beneficiary to commence a new pension then the beneficiary will need to ensure they meet the minimum pension standards on that pension.

Mistake #5: Incorrectly applying the GPA concession

Where a pension has failed to meet the minimum pension standards, the Commissioner of Taxation allows Trustees to self-assess whether they are eligible to use the General Powers of Administration (GPA) concession and still claim ECPI on that pension. There is a list of specific criteria that must be satisfied in order to take advantage of the GPA concession. One criterion is that the underpayment does not exceed one-twelfth of the minimum pension payment required. We have occasionally seen in the past some Trustees trying to use the GPA concession for an underpayment for more than one-twelfth. Trustees who are unable to satisfy the GPA concession requirements and believe that they have a sufficient reason as to why it could not be met, can write to the Commissioner and outline why they did not meet the minimum payment requirements. The Commissioner will then determine whether the fund is still eligible to claim ECPI.

Conclusion

With the end of the financial year quickly approaching, it is important that Trustees double check that their pensions will meet the minimum pension standards. One simple oversight could result in the superannuation income stream failing to meet the minimum pension standards and the Fund having to pay tax on the earnings associated with that pension interest.

Please be aware that whilst all care is taken in the preparation of Act2’s actuarial certificates, it is the responsibility of the Trustee/Administrator to provide the actuary with accurate and complete information. If you believe that one of your pensions has not met the minimum pension standards and this has not been reflected in your application, then please contact our friendly team on 1800 230 737 to arrange an amendment free of charge.

Rebecca Oakes B.Bus, Adv Dip FP, SSATM SMSF Technical Manager 1800 230 737 | rebecca@act2.com.au

1 See Income Tax Assessment Amendment (Superannuation Measures No. 1) Regulation 2013

2 See section 6.21(2)(a)(ii) of the Superannuation Industry (Supervision) Regulations 1994 (SISR)

References

Schedule 7 of the Superannuation Industry (Supervision) Regulations 1994 http://classic.austlii.edu.au/au/legis/cth/consol_reg/sir1994582/sch7.html

Australian Taxation Office, Pension standards for self-managed super funds, ATO last modified 1 Nov 2018, viewed 18 January 2019

https://www.ato.gov.au/Super/Self-managed-super-funds/In-detail/SMSF-resources/SMSF-technical/Pensionstandards-for-self-managed-super-funds/

Australian Taxation Office, Starting and stopping a super income stream (pension), last updated 26 September 2018, viewed 18 January 2019

https://www.ato.gov.au/Super/APRA-regulated-funds/In-detail/APRA-resources/APRA-funds-starting-andstopping-a-super-income-stream-(pension)/

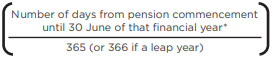

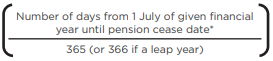

Appendix 1

1. Pension commences during financial year Minimum

Payment Amount = Account Balance x Percentage Factor x

1. Pension ceases during financial year

Payment Amount = Account Balance x Percentage Factor x

1. Pension commences and ceases during the same financial year

Minimum Payment Amount = Account Balance x Percentage Factor x

*Inclusive of first date and last date

Disclaimer

The information in this document is provided by Act2 Solutions Pty Limited ABN (Act2 Solutions). It is factual information only and is not intended to be financial product advice, tax advice or legal advice and should not be relied upon as such. The information is general in nature and may omit detail that could be significant to your particular circumstances. While all care has been taken to ensure the information is correct at the time of publishing, superannuation and tax legislation can change from time to time and Act2 Solutions is not liable for any loss arising from reliance on this information, including reliance on information that is no longer current. Tax is only one consideration when making a financial decision. We recommend that you seek appropriate professional advice before making any financial decisions.