Last week the Government announced a range of economic stimulus measures in response to COVID-19. These changes include amending the minimum payment amounts for account-based pensions, market linked pensions and allocated pensions. There are two ways to understand the impact of these changes – the simple way, and the detailed way.

Keeping it Simple

If you pay an account-based pension, market linked pension or allocated pension, and you use Schedule 7, 6, 1A or 1AAB to calculate the minimum payment amount in order to meet Minimum Pension Standards, the changes the Government has introduced means once you’ve calculated the minimum pension amount divide the answer by 2. Simple! Existing proportionate calculation rules apply when commencing pensions during the year and rounding to the nearest $10 rules also apply. If you were paying pensions in financial years 2008/09, 2009/10 or 2010/11 these changes will look familiar as the same changes put in place in those years have been extended to financial years 2019/20 and 2020/21. Defined Benefit Pensions (lifetime and life expectancy pensions) are not impacted by this change.

Existing proportionate calculation rules apply when commencing pensions during the year and rounding to the nearest $10 rules also apply. If you were paying pensions in financial years 2008/09, 2009/10 or 2010/11 these changes will look familiar as the same changes put in place in those years have been extended to financial years 2019/20 and 2020/21. Defined Benefit Pensions (lifetime and life expectancy pensions) are not impacted by this change

The Detail

Some of us also like to understand the detail and if you are one of those people, we’ve pulled together more information regarding the change and how it applies in each of the payment calculation Schedules within the SIS Regulations. On March 24 the Government passed the Coronavirus Economic Response Package Omnibus Act 2020. Within this Act it specifies that the following clauses within the Superannuation Industry (Supervision) Regulations 1994 will be updated to include “1 July 2019 and 1 July 2020”:

- Cause 4A of Schedule 7 (account-based pensions and annuities)

- Clause 10 of Schedule 6 (market linked pensions and annuities)

- Clause 3A of Schedule 1A (allocated pensions and annuities commenced before 1 Jan 2006)

- Clause 3A of Schedule 1AAB (allocated pensions and annuities commenced on or after 1 Jan 2006)

Most articles written about the changes to the SIS Regulations refer only to the percentage factor table used to calculate minimum payments for accountbased pensions in Schedule 7. However there have also been changes made to how minimum payments are calculated for market linked pensions as well as allocated pensions. This document explains the changes to all types of pensions and annuities impacted by the change.

Account-Based Pensions

Schedule 7 of the SIS Regulations determines the minimum payment amount for account-based pensions. The minimum annual payment is determined by the formula:

account balance x percentage factor

For financial years 2019/20 and 2020/21 the minimum payment is half the amount determined under the above formula. In effect, that results in an updated minimum percentage factor for each age group as follows:

| Age | Minimum percentage factor prior to change | Minimum percentage factor for FY 2019/20 and 2020/21 |

|---|---|---|

| Under 65 | 4% | 2.0% |

| 65-74 | 5% | 2.5% |

| 75-79 | 6% | 3.0% |

| 80-89 | 9% | 4.5% |

| 90-94 | 11% | 5.5% |

| 95 or more | 14% | 7.0% |

Once the payment factor has been applied, the minimum payment amount is to be rounded to the nearest 10 whole dollars. If the amount ends in an exact 5 dollars, it is to be rounded up to the next 10 whole dollars.

Market Linked Pensions

Schedule 6 of the SIS Regulations determines the acceptable range of payment for market linked pensions and annuities. The annual payment is determined by the formula:

account balance

payment factor

The minimum payment amount for financial years 2019/20 and 2020/21 is the result of the above formula rounded to the nearest 10 dollars, multiplied by 45% (half the normal 90%).

coronavirus piggybank

An excerpt of the payment factor table is below. The table itself remains unchanged as the change to the minimum payment is applied after the payment factor has been applied.

An excerpt of the payment factor table is below. The table itself remains unchanged as the change to the minimum payment is applied after the payment factor has been applied.

| Term of annuity or pension remaining rounded in whole years | Payment Factor |

|---|---|

| ... | ... |

| 20 | 14.21 |

| 19 | 13.71 |

| 18 | 13.19 |

| 17 | 12.65 |

| 16 | 12.09 |

| 15 | 11.52 |

| ... | ... |

Within the SIS Regulations it also allows for the account balance to be paid out in full if the balance of the account falls below the annual payment amount calculated using the above formula, prior to the minimum adjustment being made, minus any payments already made. Therefore, if the account balance falls below the amount left to pay to reach the minimum payment amount, it is sufficient to pay the account balance.

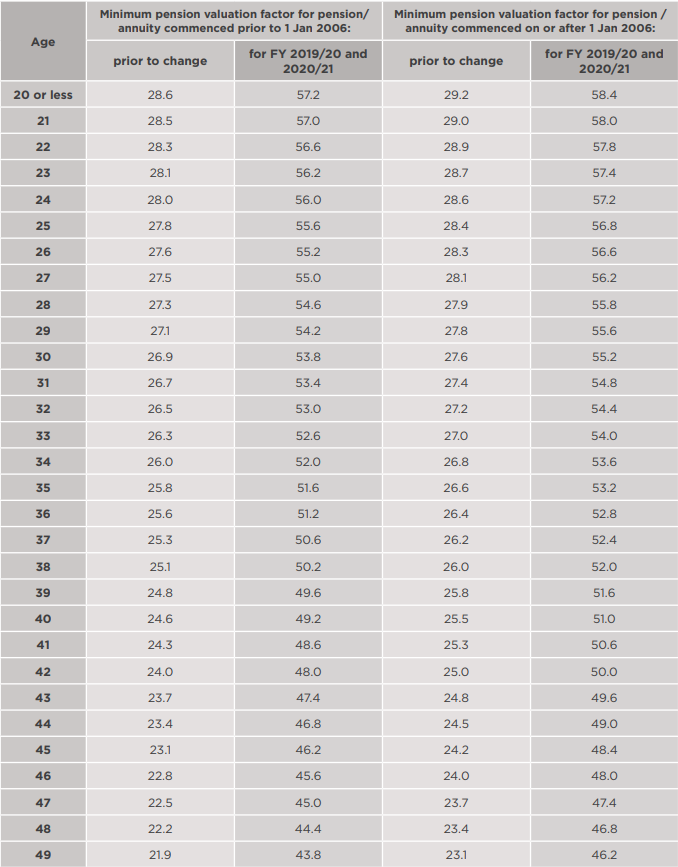

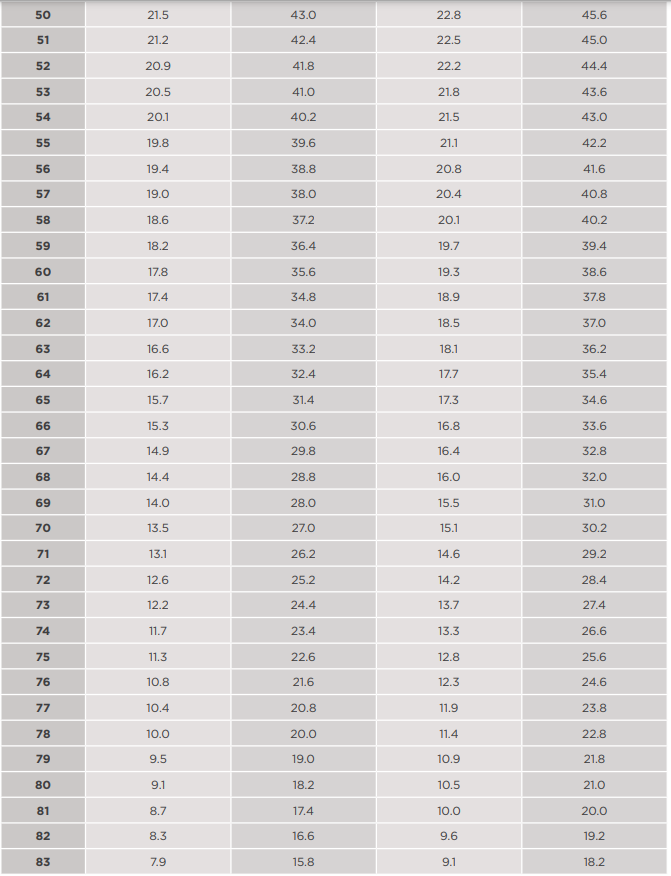

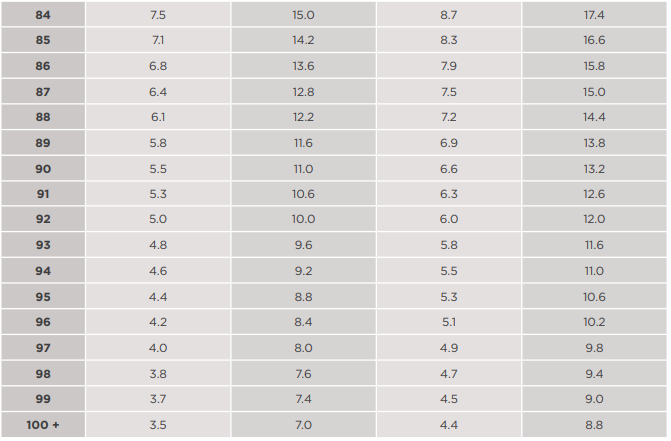

Allocated Pensions

Schedule 1A and 1AAB of the SIS Regulations determines the minimum and maximum payments for allocated pensions. The minimum payment is determined by the formula:

account balance

minimum pension valuation factor

For financial years 2019/20 and 2020/21 the minimum payment is half the amount determined under the above formula. In effect, that results in an updated minimum pension valuation factor table. The updated table is available at the end of this document. The minimum payment amount is to be rounded to the nearest 10 whole dollars.

Calculating Minimum Payments When Commencing Pensions in 2019/20 or 2020/21

If a new pension was commenced this financial year prior to the Government announcement being made, the changes to the minimum payments still apply to these pensions.

The calculation of minimum payments in the year that the pension commences should be proportionally adjusted for the number of days in the financial year that include and follow the commencement day. Provided the pension qualifies for the change to the minimum payment changes then the new minimum payment amount is half that of the amount it would have been prior to the Government changes.

When calculating the proportionate minimum payment for account-based pensions and allocated pensions, ensure the minimum payment is rounded to the nearest 10 dollars as the final step in the calculation. For market linked pensions the proportionate calculation is applied to the annual calculation amount prior to any minimum or maximum adjustment ratios being applied. Ensure during the calculation you round the pro-rata payment amount to the nearest 10 dollars then multiply the result by 45% to obtain the minimum payment amount.

Note that for account-based pensions, if the commencement day is on or after 1 June in a financial year, no payment is required to be made for that financial year.

Already Paid More than the New Minimum Payment Amount?

With only three months left in the 2019/20 financial year it is possible that you have already paid above the minimum drawdown amount. If this is the case, you can cease making payments for the remainder of the year. Recontributing these amounts is possible in some circumstances, however, before making any recontributions it is important to understand eligibility and any other rules or limits such as contribution caps.

Allocated Pension Minimum Pension Valuation Factor

References

Coronavirus Economic Response Package Omnibus Act 2020

https://www.legislation.gov.au/Details/C2020A00022

Schedule 1A of the Superannuation Industry (Supervision) Regulations 1994

http://classic.austlii.edu.au/au/legis/cth/consol_reg/sir1994582/sch1a.html

Schedule 1AAB of the Superannuation Industry (Supervision) Regulations 1994

http://classic.austlii.edu.au/au/legis/cth/consol_reg/sir1994582/sch1aabschedule.html

Schedule 6 of the Superannuation Industry (Supervision) Regulations 1994

http://classic.austlii.edu.au/au/legis/cth/consol_reg/sir1994582/sch6.html

Schedule 7 of the Superannuation Industry (Supervision) Regulations 1994

http://classic.austlii.edu.au/au/legis/cth/consol_reg/sir1994582/sch7.html

Key Superannuation Rates and Thresholds

https://www.ato.gov.au/Rates/Key-superannuation-ratesand-thresholds/?anchor=Minimumannualpaymentsforsuperincomestrea

Disclaimer

The information in this document is provided by Waatinga Pty Ltd, it is factual information only and is not intended to be financial product advice, tax advice or legal advice and should not be relied upon as such. The information is general in nature and may omit detail that could be significant to your particular circumstances. While all care has been taken to ensure the information is correct at the time of publishing, superannuation and tax legislation can change from time to time and Waatinga Pty Ltd is not liable for any loss arising from reliance on this information, including reliance on information that is no longer current. Tax is only one consideration when making a financial decision. We recommend that you seek appropriate professional advice before making any financial decisions