For SMSFs that incur general expenses from assets gaining or producing both Exempt Current Pension Income (ECPI) and assessable income in a given financial year, they may be eligible to claim a portion of the expenses as deductible. To calculate the apportionment fairly and reasonably, there are two methods available under Section 8.1 of Tax Ruling (TR) 93/17.

Generally speaking, expenses that are incurred in producing assessable income (e.g. expenses related to assets supporting non-retirement phase accounts) are fully deductible whilst general expenses that were incurred in producing ECPI (e.g. expenses related to assets supporting retirement phase accounts) are generally non-deductible.

It is important to be aware that there are some expenses that have a specific deduction provision applied to them that allows them to be fully or partially deductible.

Fully deductible expenses include actuarial certificate fees, supervisory levy, death premiums and disability premiums. Expenses that are not eligible for a deduction include expenses that of a capital nature, private or domestic nature.

For general expenses that have been incurred from assets supporting both non-retirement phase and retirement phase accounts an apportionment needs to be applied that is fair and reasonable. Section 8.1 of Tax Ruling 93/17 sets out two methods that are to be considered a fair and reasonable approach.

Two methods of calculation

Method 1: Using the actuary’s percentage

Where a fund has a mix of unsegregated non-retirement and retirement phase accounts during a given financial year, the SMSF is required to obtain an actuarial certificate in order to be able to claim ECPI under the Unsegregated Method. The ATO considers it to be fair and reasonable to use the actuary’s tax-exempt percentage as a method in determining the deductibility of general expenses. This is because the actuary’s calculation is a daily weighted average of the unsegregated retirement phase liabilities divided by a daily weighted average of the unsegregated superannuation liabilities. To calculate the portion of deductibility using the actuary’s tax-exempt percentage the following method applies:

- Expenses x ‘assessable income percentage’

Where ‘assessable income percentage’ is 100% - actuary’s tax-exempt percentage

Example 1:

Consider the Super Smart Super Fund where Samantha is the sole member. Samantha has a mix of retirement phase and non-retirement phase accounts throughout the 2019 financial year and is required to use the Unsegregated Method to claim ECPI. The Super Smart Super Fund applies for an actuarial certificate with Act2 Solutions and receives an actuarial percentage back of 60%.

The Trustee of the Super Smart Super Fund identifies that there has been $7,000 in general expenses incurred during the 2019 financial year from the

assets supporting both retirement phase and non-retirement phase accounts. As the Trustee is unable to clearly identify which general expenses were incurred from producing assessable income and which were incurred from producing ECPI, they will need to choose a method to calculate the deductibility of the general expenses. The Trustee decides to use the actuary’s percentage method and calculates the general expense deduction as follows:

Step 1:

100% - actuary’s tax-exempt percentage = assessable income percentage 100% - 60% = 40%

Step 2:

Expenses x ‘assessable income percentage’

$7,000 x 40% = $2,800

As a result, $2,800 is deductible from the $7,000 in general expenses that were incurred during the financial year.

Method 2: Income ratio method

Under Section 8(2) of Tax Ruling 93/17 there is another method that Trustees can choose to use to calculate the general expense deduction. The formula is: General administrative expenses * [Assessable income/Total income] where: • Assessable income includes assessable investment income (excluding ECPI), non-concessional contributions, concessional contributions and rollovers. • Total income means assessable income plus exempt income and non-assessable non-exempt income.

Example 2:

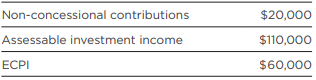

Consider the same circumstances as Example 1 however the following additional information also applies:

Step 1: Calculate assessable income

Assessable income = contributions + rollovers +

assessable investment income

$130,000 = $20,000 + $0 + $110,000

Step 2: Calculate total income

Total income = assessable income + ECPI

$190,000 = $130,000 + $60,000

Step 3: Apply the formula specified under section 8(2) of TR 93/17

General administrative expenses * [Assessable income/total income]

$7,000 * [$130,000/$190,000]

$7,000 * 0.6842

$4,789

As a result, $4,789 is deductible from the $7,000 in general expenses that were incurred during the financial year.

It is important to note that where an SMSF selects a specific method of apportionment, the ATO expect that the method chosen is continually used over the years and the Trustees do not regularly switch between methods within a small period of time. The ATO have highlighted in section 8C of Tax Ruling 93/17 that if an SMSF chooses to change methods of apportionment that there must be a specific reason for doing so.

Conclusion

It is important for Trustees to be aware of which expenses are fully deductible, partially deductible and non-deductible when completing the SMSF annual return. For expenses that require apportionment, section 8.1 of Tax Ruling 93/17 provides two methods that are considered to be fair and reasonable.

It is worthwhile to note that although the actuarial method is the simplest to calculate, the income method may provide a better result for SMSFs that receive material contributions and rollovers.

Rebecca Oakes B.Bus, Adv Dip FP, SSATM SMSF Technical Manager 1800 230 737 | rebecca@act2.com.au

References

Section 8.1 of the Income Tax Assessment Act 1997 http://classic.austlii.edu.au/au/legis/cth/consol_act/ itaa1997240/s8.1.html

Section 8.1 of Tax Ruling 93/17

https://www.ato.gov.au/law/view/document?DocID=TXR/ TR9317/NAT/ATO/00001&PiT=99991231235958

Section 25-5 of Income Tax Assessment Act 1997 http://classic.austlii.edu.au/au/legis/cth/consol_act/ itaa1997240/s25.5.html