The Australian Government have released further details regarding proposed changes to claiming Exempt Current Pension Income (ECPI) which will attempt to reduce complexity and associated reporting costs for Trustees.

Two proposed amendments:

Originally revealed back in the 2019/20 Federal Budget, the Australian Government announced that they would seek to reduce red tape for superannuation funds by streamlining some of the administration requirements for the calculation of Exempt Current Pension Income.

The Government have now put forward two proposed amendments to the Income Tax Assessment Act 1997 (ITAA 97) which will directly impact claiming ECPI. The first proposed amendment will allow superannuation fund trustees to choose which method they use when claiming ECPI where the fund is in full retirement phase for part of the income year but not for the full income year. The second proposed amendment is to remove a redundant requirement to obtain an actuarial certificate when the fund is in full retirement phase for the entire financial year.

To better understand what these two proposed changes mean for claiming ECPI, let’s recap on the existing law and breakdown what the proposed new laws are.

1. Providing choice around which method can be used for claiming ECPI

Existing law:

Where an SMSF is eligible to use the Segregated Method in a given financial year and there are periods during the financial year where the SMSF is solely supporting retirement income streams then those periods are ‘deemed’ to be segregated. The Trustees must use the Segregated Method to claim ECPI for those periods.

Proposed new law:

The Government have proposed to amend the definition of a segregated asset so that superannuation trustees can choose whether to treat an asset as a segregated current pension asset where all of the fund’s assets are fully in retirement phase. This means that for SMSFs that are eligible to use the Segregated Method in a given financial year and have periods during the financial year where the fund is solely supporting retirement phase, Trustees can choose whether those periods are segregated or unsegregated for the purposes of claiming ECPI. It is important to note that for funds solely supporting retirement phase for the entire financial year will not have this choice and will have to use the Segregated Method for claiming ECPI. This proposed new law will only apply to Account Based Pensions, Market Linked Pensions and Allocated Pensions.

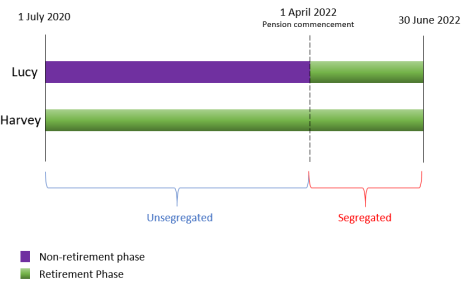

Harvey and Lucy are members of the Show Me the Money Super Fund. At 1 July 2021, Harvey’s entire superannuation interest is paying an Account Based Pension (ABP) and Lucy is solely in non-retirement phase. On 1st April 2022, Lucy turns 65 and commences an ABP with her entire non-retirement phase balance. From 1st April 2021, all of the fund’s assets are solely supporting retirement income streams.

Just prior to the beginning of financial year, neither member had a Total Superannuation Balance that exceeded $1.6 million and therefore the SMSF is eligible to use the Segregated Method in the 2021/22 financial year.

Under the proposed new law, the Trustees of the Show Me the Money Super Fund could choose whether they wish to treat the period 1 April 2022 – 30 June 2022 as unsegregated or segregated. If they chose to treat the period as segregated, then all ordinary and statutory income received during that period will be 100% tax exempt under the Segregated Method. The fund then would be required to use the Unsegregated Method for the period 1 July 2021 – 31 March 2021 and the actuary’s tax exempt percentage on the actuarial certificate would be calculated on the unsegregated period and would only apply to earnings received during the unsegregated period.

Alternatively, the Trustees could choose not to treat the full retirement phase period as a segregated period and therefore the fund would be unsegregated for the entire financial year and the actuary’s tax exempt percentage would be calculated based on the entire year and would apply to earnings received during the entire year.

Option A: Choose to treat the full retirement phase period as Segregated

Option B: Choose the Unsegregated Method for the entire financial year

2. Amend the Disregarded Small Fund Assets legislation to remove the requirement for some funds to obtain a 100% tax exempt actuarial certificate

Existing Law:

Where a fund is not eligible to use the Segregated Method (i.e. they have Disregarded Small Fund Assets) and they are solely supporting retirement phase for the entire financial year, the SMSF is required to use the Unsegregated Method for the given financial year and obtain an actuarial certificate that states 100% income tax exemption.

Proposed New Law:

The Government have proposed to amend section 295.377 – Disregarded Small Fund Assets of the ITAA 97 to remove the requirement to obtain an actuarial certificate for funds solely in retirement phase for the entire financial year. This proposed new law will apply for 2021/22 and onwards. It is important to note that this proposed amended new law will not apply to Defined Benefit Pensions.

Conclusion

The proposed amendments to ITAA 97 have been released for consultation until 18 June 2021. The Act2 team will be following this very closely and once the proposed Bill has been given Royal Assent, Act2 will work very closely with our friends at BGL360, Class Super and Supermate to ensure a smooth update to our integration. Our aim is to continue to provide our clients with an excellent, fast and reliable service. Premium service is our brand, and we will continue to support our clients through the next phase of ECPI changes.

References

Australia Government – The Treasury, Reducing red tape for superannuation funds – ECPI measurements, last updated 21 May 2021, viewed 21 May 2021

https://treasury.gov.au/consultation/c2021-173636

Rebecca Oakes B.Bus, Adv Dip FP, SSA

Head of Technical Services

1800 230 737 | rebecca@act2.com.au