SMSFs that have deemed segregated periods during a given financial year will now be able to choose whether to keep those periods as Segregated or use the Unsegregated Method for the entire financial year. This ‘choice’ will provide Trustees with greater opportunity to strategically maximise their Exempt Current Pension Income (ECPI) outcome.

The Government have also confirmed that Trustees will not have to make a formal election when making their decision and it does not have to be submitted to the ATO. Trustees will be expected however to keep a record of any choice they make and details of the calculation they use. If the Trustees for an eligible fund do not make a choice, then the Fund’s ECPI will need to be calculated using the Segregated Method for periods during the financial year where the Fund is solely supporting retirement phase 1.

Which circumstances does this ‘choice’ not apply to?

-

The choice will not apply to Defined Benefit Pensions. It only applies to Account Based Pensions, Market Linked Pensions and Allocated Pensions.

-

Financial years 2017/18, 2018/19, 2019/20 and 2020/21 will still have the old law apply to them. This means that for these years, where a Fund is eligible to use the Segregated Method and has periods during the financial year solely supporting retirement phase, those periods will be deemed segregated and the Fund will have to use the Segregated Method for claiming ECPI for those periods.

-

Funds that are solely supporting retirement phase income streams for the entire financial year will still be required to use the Segregated Method when claiming Exempt Current Pension Income in the SMSF Annual Return.

-

The choice will not apply to SMSFs that have Disregarded Small Fund Assets (i.e. they are not eligible to use the Segregated method for a given financial year). These funds will have to use the Unsegregated Method for the entire financial year.

How does this ‘choice’ work in practice?

SMSFs that have deemed segregated periods during a given financial year will now be able to choose whether to keep those periods as Segregated or use the Unsegregated Method for the entire financial year.

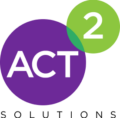

Example 1 – Sale of a property

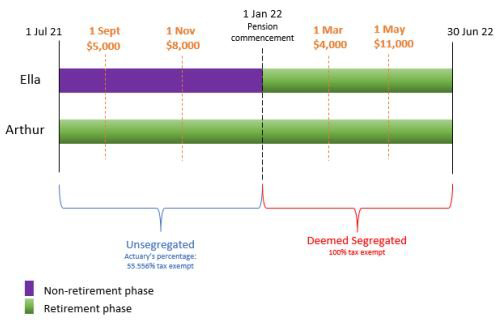

Arthur and Ella are members of the Yellow Brick Road Super Fund. At 1 July 2021, Arthur’s entire superannuation interest of $500,000 is paying an Account Based Pension (ABP) and Ella’s entire balance of $400,000 is solely in accumulation phase. On 1 January 2022, Ella retires and commences an ABP with her entire accumulation balance. From 1 January 2022, all of the Fund’s assets are solely supporting retirement phase income streams. On 1 April 2022, the members sell a property which they jointly hold together.

Just prior to the beginning of financial year, neither member had a Total Superannuation Balance that exceeded $1.6 million and therefore the SMSF is eligible to use the Segregated Method in the 2021/22 financial year (in other words it does not have Disregarded Small Fund Assets).

As this Fund is eligible to use the Segregated Method for the 2021/22 financial year and the Fund is solely supporting retirement phase from 1 January 2022 – 30 June 2022, the Trustees have a choice as to which method/s they can use to calculate ECPI.

Option 1: Use the Segregated and Unsegregated Method

As the Fund is eligible to use the Segregated Method and is solely supporting retirement phase from 1 January 2022 – 30 June 2022, the Fund can be deemed segregated for that period. All the earnings received during the deemed segregated period will be entirely tax exempt under the Segregated Method. The period of 1 July 2021 – 31 December 2021 will be Unsegregated and require an actuary’s tax exempt percentage. In this scenario, the actuary’s percentage would be 55.556%. If a capital gain was realised from the sale of the property, then as it was realised during the deemed segregated period, it will be 100% tax exempt under the Segregated Method. Alternatively, if a capital loss was realised from the sale of the property, then as it was realised during a segregated period, the capital loss would need to be disregarded.

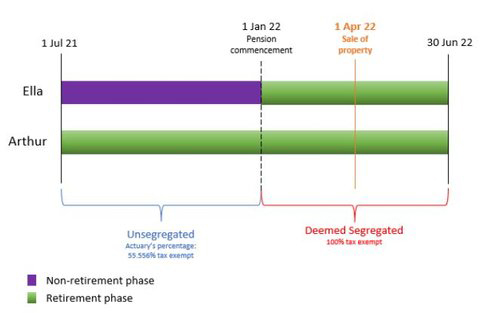

Option 2: Use the Unsegregated Method

Alternatively, the Trustees of the Yellow Brick Road Super Fund could choose to use the Unsegregated Method for the entire financial year. The actuary’s percentage would apply to the entire financial year and in this scenario the actuary’s percentage would be 77.595%. The capital gain realised would therefore be 77.595% tax exempt. If a capital loss was realised from the sale of the property then as it was realised during a unsegregated period, the capital loss could be realised and any net capital losses could be carried forward.

As you can see from this example, the best option to choose for calculating ECPI will depend on whether the sale of the property incurred a capital gain or a capital loss. Once the Trustees have made their decision as to which option they will use, they will need to record their choice and details of the calculation they use. If the Trustees do not make a choice, then the Fund’s ECPI will be calculated based on Option 1.

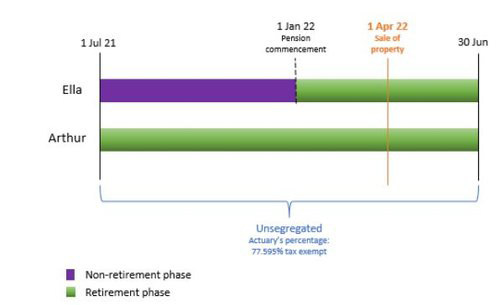

Example 2 – Sporadic income distributions

Consider the same circumstances as the previous example however this time rather than the sale of a property, the Fund receives sporadic income distributions of $5,000 on 1 September 2021, $8,000 on 1 November 2021, $4,000 on 1 March 2022 and $11,000 on 1 May 2022.

As the Fund is eligible to use the Segregated Method and there is a period during the financial year solely supporting retirement phase, the Trustees have two options to consider.

Option 1: Use the Segregated and Unsegregated Method

The Trustees could choose to the Segregated Method for the period where the Fund is solely supporting retirement phase (1 January 2022 – 30 June 2022) and the Unsegregated Method for the period where there is a mixture of retirement and non-retirement phase (1 July 2021 – 31 December 2021). If this option was chosen, then the Fund’s ECPI would be calculated as follows:

| Unsegregated ECPI |

$7,222

($5,000 + $8,000) x 55.556% |

|

PLUS

Segregated ECPI

|

$15,000 ($4,000 + $11,000) (All income earned from segregated current pension assets are 100% tax exempt) |

|

EQUALS

Total ECPI

|

$22,222 |

Option 2: Use the Unsegregated Method

Alternatively, the Trustees could choose to use the Unsegregated Method for the entire financial year. In this case, the Fund would require an actuarial certificate which would apply to the entire financial year. In this example, the actuary’s percentage would be 77.595% and the Fund’s ECPI would be calculated as follows:

| Unsegregated ECPI |

$21,727

($5,000 + $8,000 + $4,000 + $11,000) x 77.595% |

As you can see by comparing both options, Option 2 would give a slightly higher ECPI result in this example.

Which method should the Trustees choose?

This decision is completely up to the Trustees however as you can see from Example 1, the timing of income and capital losses would play an important role in determining which option would give the Fund the best outcome. Generally speaking, if the majority of the income was received during full retirement phase period/s then keeping the deemed segregated period will most likely result in a higher ECPI outcome. Alternatively, if the majority of income was received during a period of both retirement phase and non-retirement phase, then using the Unsegregated Method for the entire financial year will most likely result in a higher ECPI outcome.

As for capital losses, it is important for Trustees to be aware that any capital losses incurred from segregated assets will be disregarded. Therefore, if the Trustees choose to have full retirement phase periods as segregated then any capital losses incurred during those periods will be disregarded.

Conclusion

The amendment to section 295.385 of the Income Tax Assessment Act 1997 has provided Trustees with a greater choice when it comes to calculating ECPI. By considering the timing of income and capital losses, Trustees can now strategically make their decision based on which result will give them the most optimal ECPI outcome.

Reference

Treasury Laws Amendment (Enhancing Superannuation Outcomes For Australians and Helping Australian Businesses Invest) Bill 2021, viewed 11 February 2022. https://parlwork.aph.gov.au/Bills/ r6800

Rebecca Oakes B.Bus, Adv Dip FP, SSA

Head of Technical Services

1800 230 737 | rebecca@act2.com.au